The following analysis of the Eastern Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate Agent.

REGIONAL ECONOMIC OVERVIEW

Following the COVID-19-induced slowing of employment growth, Eastern Washington had a solid recovery in place. However, as infections increased between last November and this January, that recovery stalled. Employment in retail trade and transportation saw job levels drop. There was also a significant decline in Professional & Business Services in the Kennewick area. According to the most recent available data, employment experienced some improvement in February, but regional employment is still down more than 16,500 jobs from the pre-pandemic peak. With the labor market stalling, the unemployment rate ticked up from 6.8% in December to 6.9% in February, but I am hopeful this will turn around as the vaccine becomes more freely available.

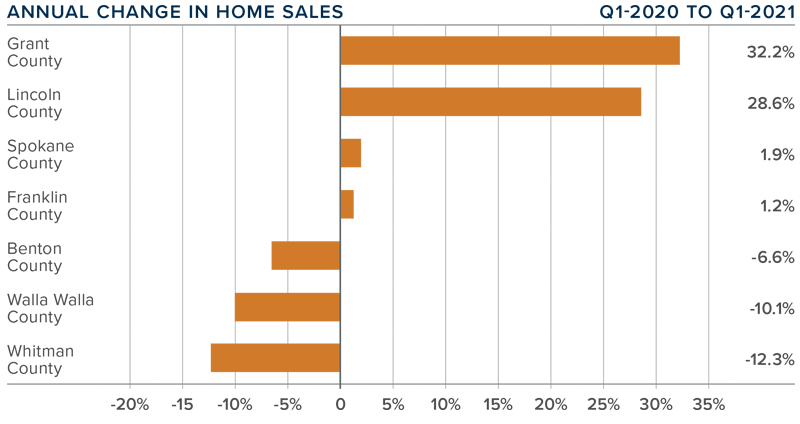

EASTERN WASHINGTON HOME SALES

❱ Home sales throughout Eastern Washington rose 1.2% compared to the same quarter in 2020, with a total of 2,467 homes sold.

❱ Tepid sales growth can be partially attributed to the lack of homes on the market. In the first quarter, there was an average of only 452 homes for sale. This is 58.9% lower than a year ago and 40.7% lower than in the fourth quarter of 2020.

❱ Sales activity rose in four counties and dropped in three. Of note was the significant growth in sales in Grant and Lincoln counties, but keep in mind that these are relatively small markets. The same can be said of the counties where sales dropped the most, so there’s no need to worry at the present time.

❱ Pending home sales were 5.5% higher than a year ago; however, they were 7.5% lower than in the fourth quarter. While the the lack of homes for sale is to blame for this drop, it does suggest that the pace of sales in the second quarter may not be positive.

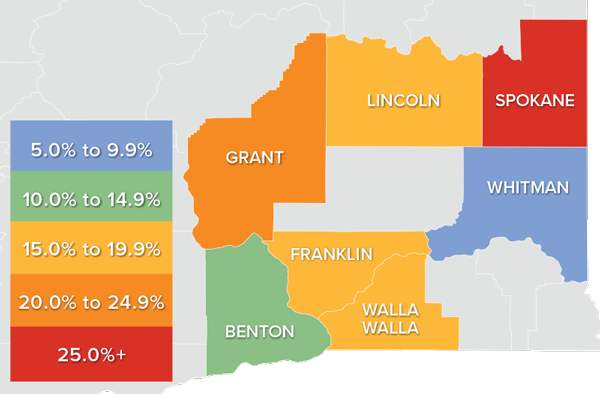

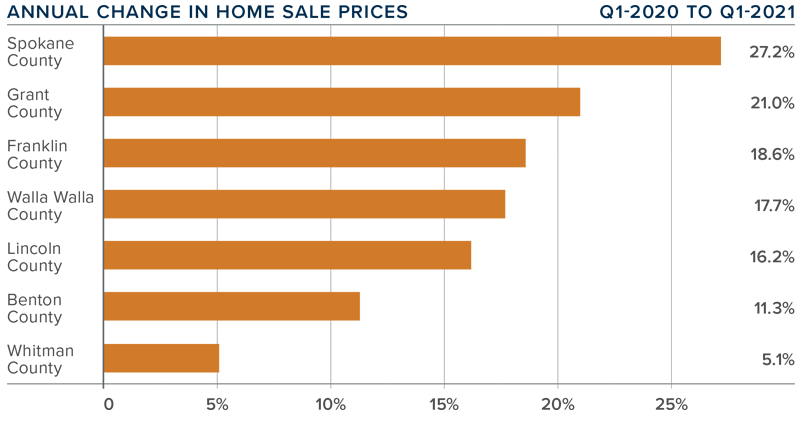

EASTERN WASHINGTON HOME PRICES

❱ Year-over-year, the average home price in Eastern Washington rose a significant 20.8% to $359,474. Home prices were also 2.6% higher than in the fourth quarter of 2020.

❱ Demand remains in place, but supply remains well below the level I would like to see. With more buyers than sellers, it’s no surprise that prices increased at rates well above the long-term average.

❱ Prices rose in every county, with double-digit increases in all but one market and very significant price growth in Spokane and Grant counties.

❱ With mortgage rates slowly increasing, one might expect the market to cool somewhat. But unless there is a significant increase in inventory, I would be surprised to see this happen in the foreseeable future.

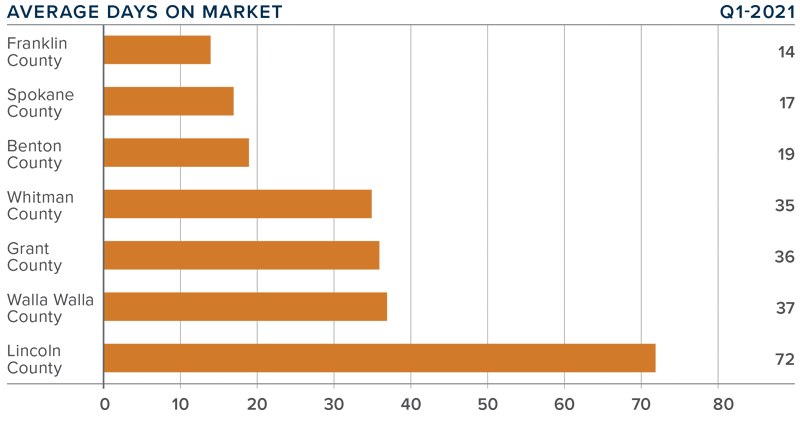

DAYS ON MARKET

❱ The average time it took to sell a home in Eastern Washington in the final quarter of 2021 was 33 days.

❱ It took 24 fewer days to sell a home in Eastern Washington in the first quarter than it did a year ago.

❱ All markets saw days-on-market drop compared to the first quarter of 2020.

❱ It took the same number of days to sell a home in the first quarter as it did during the fourth quarter of last year.

CONCLUSIONS

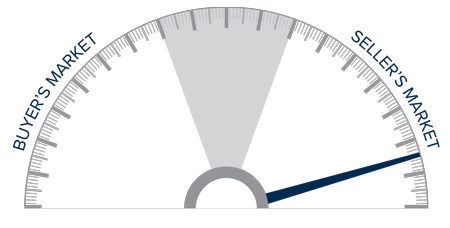

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Demand is very strong and, even in the face of rising mortgage rates, buyers are still out in force. With supply still lagging significantly, it staunchly remains a seller’s market. Furthermore, assuming that new COVID-19 infections start to trend lower, I believe even more buyers may enter the market. As such, I am moving the needle even further in favor of sellers.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link