Walla Walla Real Estate 2025 Year-End Report

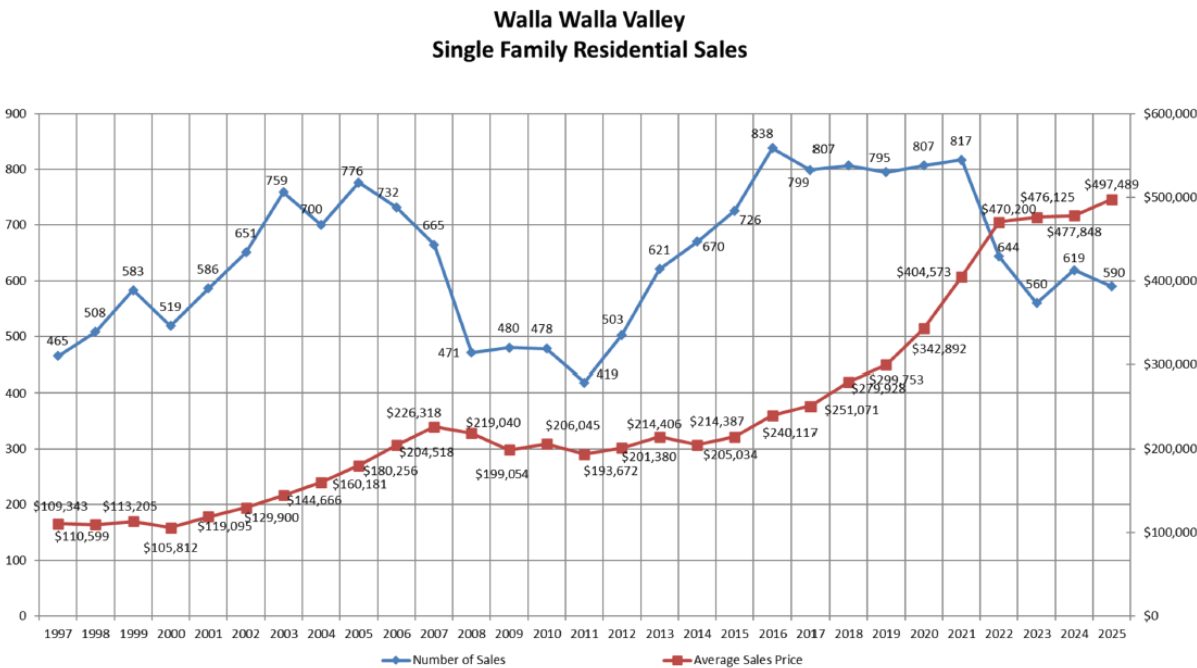

In 2025, more sellers entered the market than buyers. As a result, inventory grew, sales slowed, and price growth softened. Here are key metrics from 2025:

Home sales fell short of the previous year. Although 30-year mortgage interest rates ended 2025 at their lowest point for the year at 6.15%, home sales lagged behind last years pace. Closings fell 31% behind the previous month ended the year 5% lower than the number of homes that closed in 2024.

Listing inventory grew in 2025. Buyers had more to choices to consider during the year and by year-end there were 32% more homes listed for sale than a year ago. At the end of 2025 there was 4.3 months of inventory compared to just 2.9 at the end of 2024.

Median home price growth slowed. Declining sales coupled with increasing inventory throughout the year put downward pressure on prices. After a 5% annual increase in 2024, Medians sales annual price growth slowed to 2% in 2025.

What will 2026 bring? Windermere’s Economist, Jeff Tucker, offers the following:

1. Mortgage rates will decline slightly. Mortgage rates should remain below 6.25% for most of 2026 and could briefly dip under 6%. The Fed’s rate cut and slower growth have brought the 10 year treasury yields near 4% while the spread between treasuries and mortgage rates has narrowed to its normal range of 2% or less.

2. Existing home sales will pick up (barely). Homes sales have hovered near generational Lowes for three years. While a sharp rebound is unlikely, conditions post to a modest uptick in 2026.

3. Home prices will be roughly flat. Home prices are likely to remain flat in 2026, largely due to higher inventory putting toward pressure on values.

4. Inventory will climb to pre-pandemic levels. The number of homes for sale will likely return to pre-pandemic levels in 2026, possibly as early as spring. Inventory rose sharply in 2025, and a “shadow supply” of homes – those whose owners are waiting for better conditions – remains in the wings.

5. We will avoid a recession in 2026. After early trade policy turbulence, corporate earnings rebounded strongly and tariff concerns have faded as court challenges and new trade deal rolled back some of the costliest restrictions.

Learn More

Click here for the full monthly report

*NWMLS WA Data

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link