Walla Walla Real Estate 2024 Year-End Report

Despite hopes among potential home buyers and sellers, the Federal Reserve Bank’s three interest rate cuts in 2024 did not lead to reduced mortgage rates or a significant boost to the housing market. The 30-year mortgage interest rate was actually higher at the end of 2024 (6.85%) than at the end of 2023 (6.61%). However, there are signs that buyers and sellers may be adjusting to the new normal.

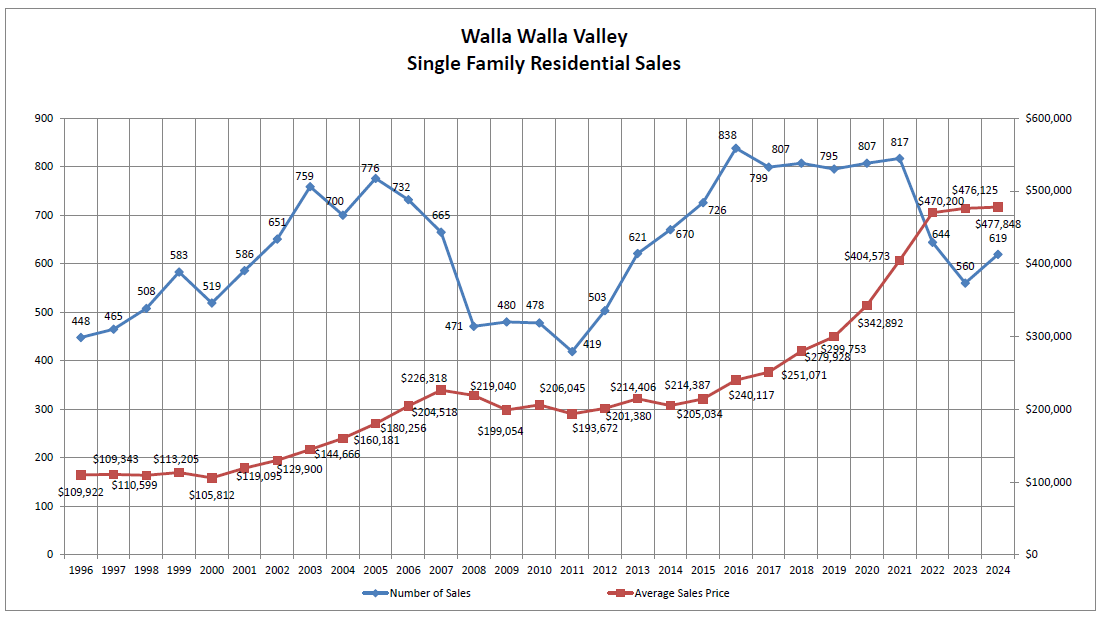

Home sales increased in 2024. Closed home sales in the Walla Walla Valley increased 11% over the previous year. However, sales were still 24% below the number of homes that sold in 2021. Yet, more buyers and sellers began to accept the new market realities and moved forward with their real estate transactions in 2024.

10 of the 12 months in 2024 experienced year-over-year inventory gains. Throughout most of the year, buyers had more homes to consider than in 2023. While multiple offers were still present, more buyers were able to purchase a home without being drawn into a bidding war. Having more sellers bring their homes to market in 2024 was a positive trend.

Median home prices grew 5% over the previous year. After seeing stagnant price growth in 2023, the Walla Walla Valley’s median sales price grew 5% to $421,855 in 2024.

What will 2025 Bring? Windermere’s Economist Jeff Tucker offers the following:

- Interest rates will decline. We are in the cool down phase of an economic cycle with decelerating inflation, a slowing job market, and the FED cutting short-term rates. Interest rates are expected to move closer to 6% but will fall in a gradual zigzag fashion.

- Existing home sales will pick up. Homes sales have been held back by low inventory and high interest rates but inventory started to return in 2024 and buyers and sellers now feel less uncertainty and are getting more comfortable with the new normal. Existing homes sales are expected to increase by 10%.

- Home prices will not fall. The last 3 years have seen a rollercoaster of gains and slowdowns when it comes to home prices thanks to the fluctuation in interest rates and the changing supply of available homes. However, the market should move back towards balance and home prices are expected to grow by 2-4%.

- Affordability will start to improve. Lower interest rate combined with increasing incomes will make it easier for many buyers to purchase homes.

- More parents will help with down payments. More baby boomers with record levels of home equity will see a down payment gift as a great way to help their adult children realize home ownership.

Learn More

Click here for the full monthly report

Click here for Market Updates

*NWMLS WA Data

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link