Walla Walla Valley Real Estate – 2021 Year-End Report

The Walla Walla valley real estate market remained remarkably resilient in the face of continued Covid-19 challenges in 2021. Here are a few takeaways:

2021 Home Sales Topped Previous Year for 2nd Best in MLS History: Strong buyer demand, fueled by low-interest rates, led to a record-setting year in the Walla Walla Valley. Annual home sales hit 817 closings, a 1.2% increase over the previous year, and set the record for the 2nd most for any year in the Walla Walla Valley. The record high of 838 annual home closings was set in 2016.

Inventory Hit Historic Low: Inventory was already low when the year began. Then it fell further. Compared to the previous year, average monthly inventory declined 37%, averaging 68 fewer listings on a monthly basis. This did not mean there was nothing to sell. New listings regularly came on the market but sold immediately, often with more than one buyer competing for the sale.

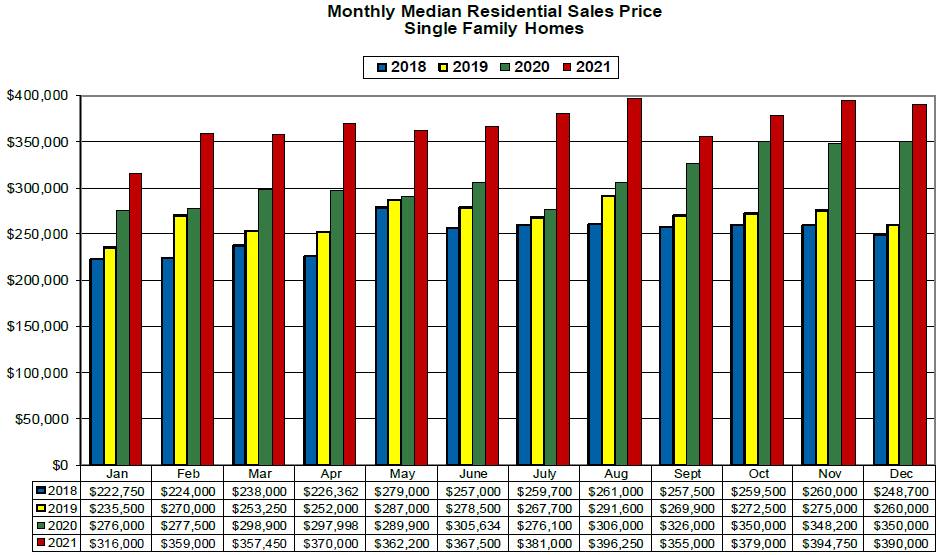

Sales Prices Set Record High: Low inventory levels, coupled with strong buyer demand for homes in the Walla Walla valley, put upward pressure on prices throughout 2021. As a result, the median sales price for 2021 increased 19% over the previous year to $368,846.

So what will 2021 bring? To help answer that question, here is a summary from Windermere’s Chief Economist, Matthew Gardner.

Home Sales: While the real estate market is projected to remain very active, home sales are expected to fall back modestly in 2022. Home sales will continue to be constricted by ongoing supply limitations as well as rising affordability issues. Demand for ownership housing will remain remarkably buoyant. We should see the market move towards balance in 2022 but it will not find equilibrium till 2023.

Mortgage Rates: Mortgage Interest rates will increase throughout 2022 but will remain below 4% through year-end. While these rates will remain at historic lows, increasing interest rates will lower the ceiling for what buyers can afford. This will put downward pressure on prices.

Prices: Nationally, prices rose 16.4% in 2021 but this pace is unsustainable. The rate of home price growth is projected to slow to around 7% in 2022. The main reasons will be increasing mortgage rates, affordability, and limited supply. 7% price growth is still significant. However, Matthew maintains “there is no bubble in sight, but housing affordability will continue to be a big challenge”.

Learn More

Click here for the full December report

Hear Housing and Economic Updates from Chief Economist Matthew Gardner

*WWMLS WA Data

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link